I have had a conversation with couple of people about the emergence of Artificial Intelligence and they were like that thing will only happen in the white countries.

You’ve been hearing of UBA Leo? Like “Chat with Leo”

Now, for those who do not know, Leo is a machine “artificial intelligence” powered chatbot for banking, developed in partnership with Facebook Messenger. The chatbot aims to make it easy for UBA customers to complete transactions via social media.

With Leo, users can open new bank accounts, check their account balances, buy airtime, and make funds transfers without extra charge.

The chatbot also makes it easy for customers to initiate loan requests, cheque confirmations, bill payment, account freezing and instant notifications on transactions.

AI at the core of digital transformation But just what form do these advances take? AI lies at the heart of things like chatbots, advanced customer credit assessment, relationship management, security, anti-money laundering and fraud detection. Chatbots draw from big data and machine learning to respond to customer queries and concerns. They can streamline customer support on routine services like banking transactions, and make product recommendations. This is customer-facing AI that helps FSI companies be ever-present for their clients, while reducing the resources required to do so.

For fraud detection, AI-powered technology enables computers to mimic, extend and amplify the thought process of a human analyst, at a pace and scale unmatched by humans. It can review trillions of transactions in every possible portfolio in the organisation. Because of this, banks, fintechs and payment facilitators are able to detect or be alerted to potential fraud – receiving fast, efficient and accurate alerts of the likelihood of an individual’s card or account being compromised, for example. Foresight beats hindsight AI and analytics can draw inference from vast stores of data and spot trends that are often beyond the possible scope of human sight, driving insight to analysts, investors and the like. AI is also able to evaluate an organisation’s public remarks and documents, bundle that up with sentiment analysis, and cross-correlate this with historical data to predict the performance of upcoming stocks, in literal split seconds. These functions provide agility and resilience in an increasingly risky global market. In short, they inject a new level of intelligence into our organisations. Pairing this with our unique human capabilities of relationship management and creativity, and we unlock huge potential for our FSI companies.

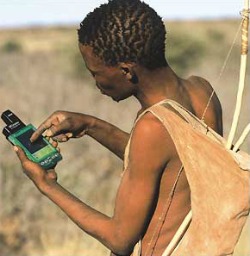

Microsoftsays through its 4Africa initiatives has its sights set on making Artificial Intelligence, AI available to everyone on the continent.

The company in a statement said this is in line with its global mission to empower every person and organisation on the planet to achieve more. “We are partnering with forward-thinking policy makers, innovative startups, technology partners, civil society groups and stakeholders to promote the growth of a vibrant AI ecosystem in Africa – one that enables inclusive growth and provides a clear and trusted path to digital transformation.”

Humans are supposed to be hired to execute these tasks but UBA prefers the machine to humans. In terms of productivity humans are nowhere near machines.

The machines are at your service 24/7, no lunch, no it’s evening I need to go back to my wife and kids.

Credibility, accuracy Machines are miles ahead.

Technology poses a big threat to humanity.

Don’t be deceived, AI is already in Africa and many companies will soon embrace its services.

I like the Hackers movie slogan : “Boot up or Shut up” Is either you embrace it or you keep quiet as you’re being left behind.